Christmas is a religious holiday that has evolved into a cultural and commercial celebration with tales of Santa Claus delivering presents on a reindeer-pulled sleigh through the night sky. Stocks markets don’t miss out either as the Santa Rally in December is the festive term applied to the phenomenon of rising equity markets. But is this seasonal boost true or a myth? Why and when does it happen? And how do we trade the “Santa Rally”?

The last month of the year has always brought with it a good feeling, and this has also historically been the case for stock markets too. Views are split as to the myriad of reasons why this positive sentiment comes about, but December is historically a good time of the year for stock market bulls.

What is the Santa Rally?

The Santa rally, also known as the Christmas rally, is a financial term used to describe the phenomenon that occurs at the end-of-year period in which stocks presumably increase in prices. Often credited to the combined impact of pre-holiday cheer and the anticipation of a fresh start in the up-coming year, savvy investors may see this as a unique opportunity to trade on the anticipated market volatility.

Why does the Santa Rally occur?

There are countless claims on why the Santa rally occurs [1]. This includes:

- The January effect – Institutional investors ready themselves ahead of and into the new year, to set up positions for the coming weeks and months.

- Rebalancing of portfolios – For tax-loss selling in December to close out losses, followed by repurchasing in January.

- Lower volumes – Liquidity is thin over the holiday period which can make it easier for bullish investors to move markets during the season of goodwill.

- Optimism in Wall Street and Market psychology – Investors know about the trend for a Santa rally so will buy stocks accordingly, leading to further gains.

- Increased holiday shopping over the Christmas season may include investing holiday or year-end bonuses.

- Large institutions taking a break and leaving the markets to retail traders who are generally more bullish

However, none of these claims have been substantiated.

When is the Santa Rally?

There is no definitive agreement on when the positive move in stocks would kick off. The term “Santa Rally” was first coined in 1972 by Yale Hirsch, the creator of the fabled Stock Trader’s Almanac [2]. He discovered that it is when markets increase in value during the last week of December and into the first two trading days of the new year.

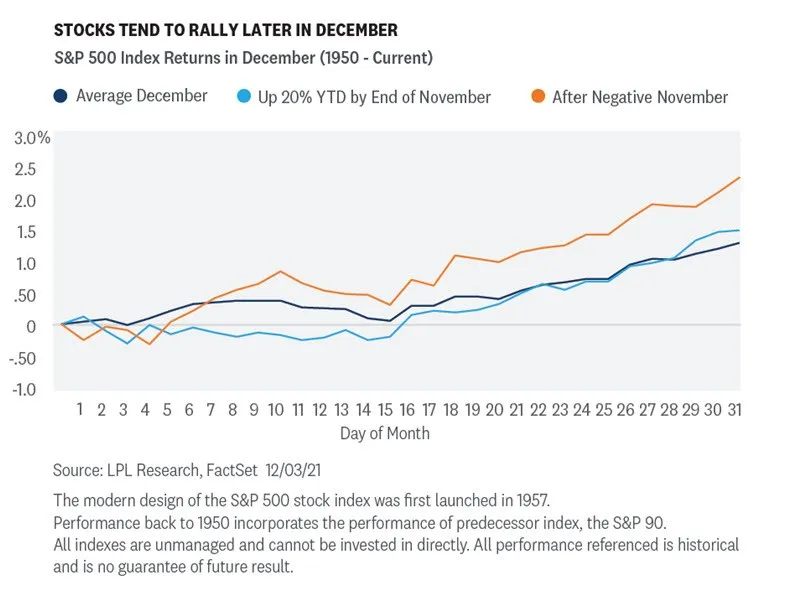

According to LPL Financial, research shows that since 1950, this single seven-day period has produced a positive return for the S&P 500 78.9% of the time. No other similar duration of trading sessions is more likely to be higher. In addition, their study indicates that this seven-day span has averaged a 1.3% gain which is the third-best seven-day run of the year [3].

Impact of the Santa Rally on Investor Behavior

The Santa Rally can have a notable influence on investor behavior, often shaping decisions and market activity in distinct ways:

- Boost in Confidence: The optimistic market environment during a Santa Rally often enhances investor confidence, encouraging a willingness to take on more risk and make investment choices with an upbeat outlook.

- FOMO Mentality: Fear of missing out on potential gains can prompt investors to rush into the market, driving increased buying activity and contributing to further price appreciation.

- Herd Mentality: The momentum of a Santa Rally can lead to herd behavior, where investors follow market trends without conducting their own research, potentially inflating stock prices and heightening volatility.

- End-of-Year Portfolio Adjustment: Fund managers may engage in strategic year-end buying of high-performing stocks to make their portfolios appear more attractive in year-end reports, amplifying the rally’s impact.

While the Santa Rally can create exciting opportunities, it’s essential for investors to stay disciplined, conduct thorough research, and align decisions with their long-term financial objectives to avoid being swayed by short-term market euphoria.

Is The Santa Rally Real?

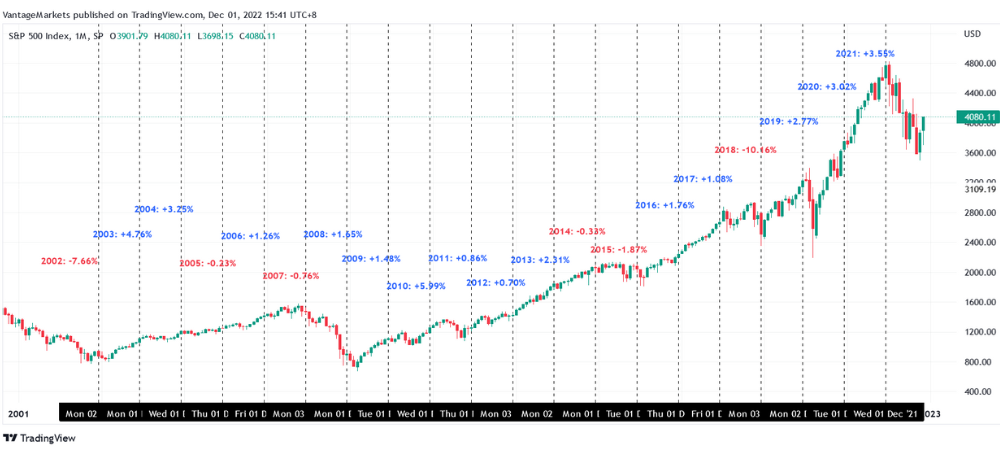

Here’s a look at how the markets have performed over the past 20 years, particularly in the month of December.

| Year (December) | Growth |

| 2002 | -7.66% |

| 2003 | +4.76% |

| 2004 | +3.25% |

| 2005 | -0.23% |

| 2006 | +1.26% |

| 2007 | -0.76% |

| 2008 | +1.65% |

| 2009 | +1.48% |

| 2010 | +5.99% |

| 2011 | +0.86% |

| 2012 | +0.70% |

| 2013 | +2.31% |

| 2014 | -0.33% |

| 2015 | -1.87% |

| 2016 | +1.76% |

| 2017 | +1.08% |

| 2018 | -10.16% |

| 2019 | +2.77% |

| 2020 | +3.02% |

| 2021 | +3.55% |

| 2022 | -5.90% |

Based on data derived from Figure 1 and 2, 14 out of the 20 Decembers that occurred from 2002 to 2021 were positive months for the overall stock market. That is an average of 70% of bullish Decembers in the past two decades. Out of the 14 bullish Decembers, the average return was +2.46% while the six bearish Decembers had an average return of -3.50%.

How To Trade the Santa Rally?

Traders can use this information as a reference to study if December is a lucrative month to enter the stock market. If an average of 2% return is substantial for a trader, December can potentially be a lucrative month but also not to overlook that trading volume in the equity market tend to decrease by 30% to 55% during the holiday seasons which often leads to whiplashes in prices [4].

However, trading just based on the Santa rally may not be sufficient for long-term success. Traders also need to apply technical analysis tools such as Fibonacci Retracement, Trend Analysis, Candlestick Patterns, Technical Indicators, and Supply & Demand just to name a few whilst having a well thought out trading plan [5].

Here are 3 factors to consider when trading the Santa Rally:

1. Fundamental & Geopolitical Focus

The stock and equity market move due to the monetary policies the Fed implements. Having a firm understanding of the Fed’s monetary movement can give an edge to traders. An example would be a low interest rate environment created by the Fed which could lead to a rather bullish stock market.

2. Diversifying Your Portfolio

Instead of focusing on just one equity, you may consider having a diversified portfolio which includes major indices such as the S&P500, NASDAQ100, and US30. A well-diversified portfolio often comes with a stronger risk management and financial security.

3. Using A Reliable Broker

When trading the Santa Rally, traders can be caught off guard by potential whipsaws in prices. Hence the need for a reliable broker such as Vantage that has features and tools catered for traders. Vantage also offers CFDs and FX spreads from as low as 0.0, $50 minimum deposit, and $0 deposit fees.

Conclusion

Although there is no evidence of the Santa Rally being a constant economic theory, statistics across the recent two decades show that December bulls still have more control over the bears. However, the average bullish returns do not outshine the bearish drawdowns. To take advantage of this end-of-year phenomenon, you may wish to consider other impacting factors that could direct the movement of the stock market during this festive week. Looking to trade the Santa rally? Try practising it with $100,000 virtual credits through your own forex demo account.

References

- “Santa Claus Rally Definition – Investopedia”. https://www.investopedia.com/terms/s/santaclauseffect.asp. Accessed 5 Dec 2022.

- “Real Santa Rally Comes After Christmas: 5 Solid Buys – Nasdaq”. https://www.nasdaq.com/articles/real-santa-rally-comes-after-christmas:-5-solid-buys-2019-12-20. Accessed 5 Dec 2022.

- “Do You Believe In The Santa Claus Rally? – LPL Research”. https://lplresearch.com/2021/12/22/do-you-believe-in-the-santa-claus-rally-2/. Accessed 6 Dec 2022.

- “Trading over the holidays? Top mistakes to avoid – Russell Investments”. https://russellinvestments.com/us/blog/trading-mistakes-holidays. Accessed 5 Dec 2022.

- “Santa Claus Rally Definition – Investopedia”. https://www.investopedia.com/terms/s/santaclauseffect.asp. Accessed 5 Dec 2022.