Choppy markets in narrow ranges ahead of key risk events

Headlines

* Markets pass time as traders await US inflation data for Fed rate cut cues

* Dollar falls modestly on lower bond yields, clears 50% Fib vs yen

* Stocks closed mixed, Dow breaks eight-day winning run

* Gold marks biggest one-day loss of the month

FX: USD closed off its lows after strength in the NY Fed inflation expectations, in a quiet day of trading ahead of a big week of data. US PPI is released tomorrow and then US CPI and US retail sales on Wednesday. We also have Powell and a bunch of Fed speakers. Sticky inflation is expected, which is likely to be too high for any rate cuts this side of summer.

EUR tried to move above the 50-day and 200-day SMAs at 1.0788 and 1.0790 respectively. There is little major eurozone data released this week apart from revisions. Markets currently price in just under three 25bps rate cuts for this year, kicking off in June.

GBP outperformed and closed above the 200-day SMA at 1.2542. It probably needs to push beyond the 50-day SMA at 1.2596 to reassert a more bullish bias. We get the first of two reports on UK jobs and wages data today before the June BoE meeting. Chief Economist Pill also speaks.

USD/JPY eventually breached 156. That came after the yen initially found some strength as the BoJ trimmed its bonds buying in yesterday’ regular operation. That was its first reduction this year and could have been done to support the yen by pushing yields higher. The 50% retracement level of the moves in the recent “yentervention” late last month and early in May sits at 156.03.

AUD consolidated just below the midpoint of the December high to April low at 0.6616. This area is where highs in January, March and April were capped. Markets will watch wages and jobs data let in the week. USD/CAD was marginally firmer after the sharp selloff and bounce on Friday’s job numbers. A big beat was supported by strong details pointing to firm economic momentum. Support sits around 1.3622.

Stocks: US equities were mixed and relatively range bound. The broad-based benchmark S&P 500 finished off 0.02% at 5,221. The tech-dominated Nasdaq 100 outperformed, adding 0.21% to close at 18,198. The Dow Jones settled down 0.21% at 39,431. That snapped its eight-day win streak. Stocks sold off on the open but made back most of the losses in quiet trade. There was an underwhelming Open AI Update which briefly hurt chip names. But Apple gained 1.7% after news that it is integrating ChatGPT into the iPhone.

Asian Stocks: APAC futures are in the green. Asian stocks traded cautiously after the mixed China inflation data over the weekend. The ASX 200 went south after tepid business survey data. The Nikkei 225 lacked any firm direction. The Hang Seng moved above 19,000 as tech led the gains.

Gold fell over 1% on the day printing its biggest loss in May. That came after the upside break late last week which saw bullion print three-week highs. The dollar dipped, yields too so there was no explicit reason for the sell-off, aside from eyes on US price data released over the next few days.

Day Ahead – UK Jobs, US PPI data

Expectations are for the UK unemployment rate in the three-month period to March to rise one-tenth to 4.3%. But note this is subject to the usual data reliability issues. The more important headline wages are forecast to slip to 5.5% from 5.6% and the ex-bonus figure is predicted to tick lower to 5.9% from 6.0%. Those figures moved sideways in February at their joint-slowest rate in 18 months. This time around, expectations are for the data to reflect further easing of labour-market tightness.

The PPI data is a forerunner for Wednesday’s CPI report. It will also likely be closely watched given that some of the components feed into the core PCE data, which is the Fed’s favoured measure of inflation. Soft figures could hint at lower PCE which is released at the end of the month.

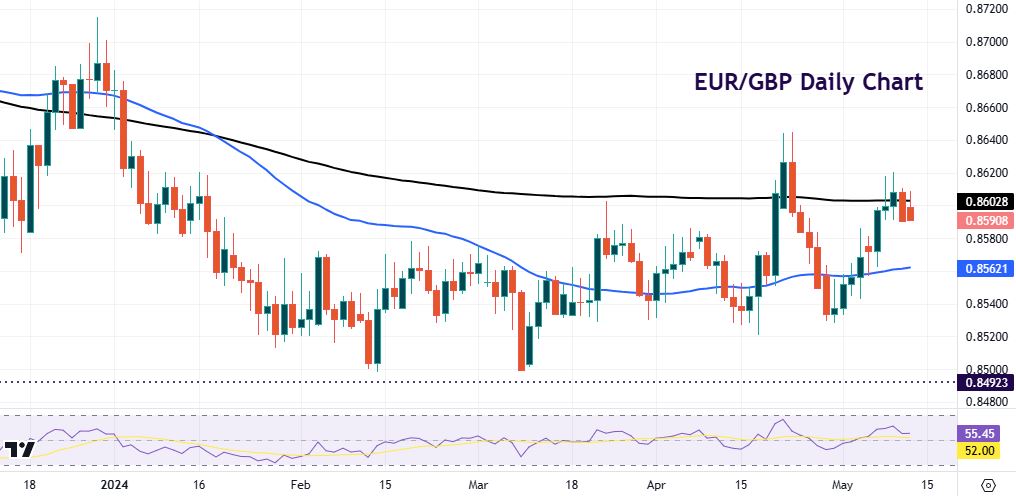

Chart of the Day – EUR/GBP capped by 200-day SMA

Debate at the Bank of England is focused on the timing of rate cuts – either on June 20th or August 1st when the next MPR is released. The BoE had been aligned more with the US at the start of the year. But now most MPC officials align with the ECB rather than the Fed. This suggests that the disinflation process provides a window of opportunity to make policy less restrictive in the near term.

The pound could be more vulnerable if repricing comes earlier with the June meeting currently a 50:50 bet. Prices are struggling again in EUR/GBP at the 200-day SMA at 0.8602. This was resistance to more protracted upside in March and April. Strong long-term support sits around 0.85 and just above.