Weekly Outlook | Waiting for the Fed, dollar turns up again

Important events this week:

The volatility only rose at times last week during high- volatile news events. The Canadian central bank and the ECB both lowered their key interest rates by 25 basis points. In both cases, this was followed by major fluctuations in markets, which then continued on Friday with the NFP- labor data. It now remains to be seen whether volatility will spike again this week. The Fed’s interest rate decision should bring clarity here. In addition, stock markets were able to generate new highs last week, but then turned down again. This could be another indication that the Fed is likely to stick to the current interest rate due to the strong labor market data.

– UK – claimant count change – In recent months, the claimant count change has remained below expectations, which might continue. The economic situation in the UK remains positive, which continues to raise the question of whether the central bank will lower interest rates next week.

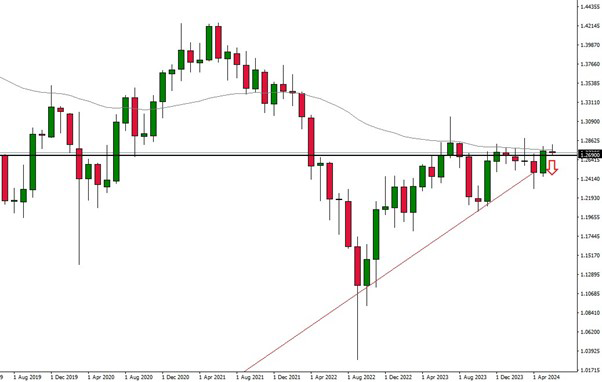

A look at the monthly chart of the GBPUSD pair shows further downside, provided the 50- moving average is not broken to the upside. Prices below 1.2700 could offer further downside potential, although “Cable” could also continue to rise if the 1.2800 area is tested to the upside. The data will be published on Tuesday, 11 June at 08:00 CET.

(pls translate accordingly: “cable” is a general term for the GBPUSD currency pair!)

– US – Inflation rate – Consumer prices in the US only continue to decline slowly. The year-on-year inflation rate is 3.4%, which is well above the Federal Reserve’s 2.0% target. This indicator serves the US Federal Reserve as an important indicator for the further course of interest rates. If the value only moves marginally downwards, the central bank is likely to take more time before adjusting rates. This could continue to help the Dollar.

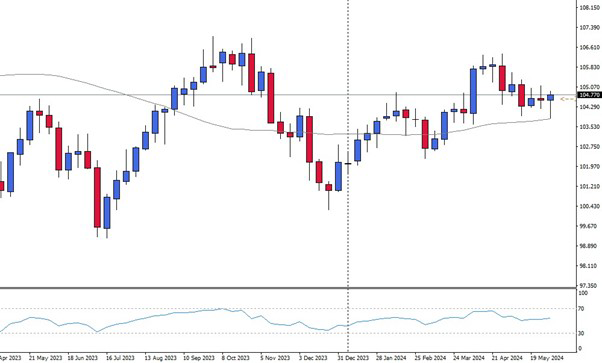

The USDX (US- Dollar index) recovered strongly last week on Friday and could indicate further potential for the Greenback. The positive trend could continue above 105.05. The data will be published on Wednesday, 12 June at 14:30 CET.

– US – Interest Rate Decision – Currently only JPMorgan Chase and Citigroup expect the Fed to cut rates this week. The inflation rate remains too high. On the other hand, economic data is slowly beginning to show a slight weakening, which can be attributed to the high level of interest rates. If the central bank will reduce rates now, this might likely weaken the Dollar again. It could then also be worth taking a look at the metals market.

The price of Silver in particular could then attempt a new breakout to the upside, as signaled by the monthly chart. An entry could be USD 30.50. The data will be published on Wednesday, 12 June at 20:00 CET.