Crude oil is a core commodity in our modern world, being the raw resource from which petroleum, plastics and other important compounds and chemicals are produced.

As an essential part of our global economic system, crude oil is not only traded as a commodity, but the price at which it trades is also used as a benchmark that guides markets and economies around the world.

There are two major global crude oil benchmarks – Brent crude, and West Texas Intermediate – each based on the prices of crude oil originating from different geographical regions, and with slightly different physical characteristics as well.

In this article, we will learn about Brent crude oil trading, what affects prices, and the various Brent crude-related instruments that traders can interact with.

Key Points

- Brent crude oil, extracted from the North Sea, is a major global benchmark for oil prices due to its light and sweet characteristics, making it easier to refine and highly valued in the global market.

- The price of Brent crude oil significantly influences global energy prices and serves as a benchmark for nearly 80% of globally traded physical crude oil, highlighting its pivotal role in economic and market dynamics.

- Trading Brent crude oil involves futures and options on major exchanges, offering opportunities for hedging against price volatility and speculation, reflecting its central role in global commodity markets.

What is Brent Crude Oil?

Brent crude oil refers to crude oil that is extracted from the North Sea, near Europe; from several oil fields including Brent, Ekofisk, Forties, and Oseberg.

We already know that crude oil is an essential natural resource that underpins the global economy. But what makes Brent crude oil so important that it has come to be regarded as a global market benchmark?

The answer lies in the relative ease with which Brent crude oil can be distilled into petroleum and refined into petroleum-based products – which is where the majority of the commodity’s value is found.

Brent crude oil is classified as “light” and “sweet”, meaning that it has a lower density, and has a sulphur content lower than 0.5%. These characteristics make Brent crude oil easier to be refined, compared to crude oils that do not have these properties [1].

The pricing of Brent crude oil is a key indicator in the global oil market, and its fluctuations can have significant impacts on energy prices worldwide.

The Brent crude oil price is often referenced in financial and commodity markets and serves as a benchmark for pricing many oil-producing countries’ exports. As of the time of writing, around 78% of globally traded physical crude oil is priced off the Brent benchmark, either directly or indirectly [2].

History of Brent Crude Oil [3]

Oil and gas deposits were first discovered onshore in the North Sea area in the mid-1800s onwards, although offshore deposits would only come to be discovered after the 1964 passing of the Convention on the Continental Shelf by the UN.

This prompted the launch of deepwater expeditions, and in 1969, Phillips Petroleum drilled a successful well in what later became known as the Ekofisk field in the Norwegian sector.

This marked the first-ever discovery of offshore oil in the North Sea, and the start of Brent crude oil history.

The discovery of the Ekofisk oil field was followed shortly by the discovery of the Brent oil field in 1971, as well as several other oil fields such as Ninian and Oseberg.

Over time, several North Sea crude oils with similar characteristics were grouped together under the term “Brent Blend.” This paved the way for a standardised benchmark for pricing and trading purposes.

As explained earlier, due to Brent crude’s favourable qualities of being light and sweet, it was an attractive reference point for the quality of crude oil.

Brent crude soon gained prominence as a global benchmark for crude oil prices, particularly in the European and Asian markets, and throughout the 1980s and 1990s, played a significant role in shaping global oil markets. It became a key indicator for traders, analysts, and policymakers, influencing investment decisions and economic forecasts.

During the 2000s, Brent crude supply started dwindling as the original oil fields were drawn down, leading to the Brent oil field being officially decommissioned in 2017.

However, crude oil extracted from newly discovered fields in the North Sea were used to continue production of the Brent Blend. Today, this allows Brent crude to maintain its status as the global benchmark for oil trading.

What is Brent Crude Oil Trading? [4]

The oil crises of 1973 and 1979 saw dramatic spikes in oil prices. To limit the economic impact of such events, the majority of crude oil commodity sales now takes place on the futures market.

Trading Brent crude oil can be performed using Brent futures contracts found on the Intercontinental Exchange in Europe, as well as the New York Mercantile Exchange (NYMEX). There are also option contracts linked to North Sea Brent crude.

Investors trading in Brent crude oil usually do so for the purpose of hedging against volatility. Some examples of such traders include companies involved in the crude oil supply chain, including refineries, and petrochem suppliers. Fuel-dependent sectors, such as airlines, may also trade Brent futures to hedge against price movements.

Trading Brent crude oil can also be done on a speculative basis to fulfil a profit-driven motive.

Why Trade Brent Crude Oil? [5]

Brent crude oil is a major energy commodity, and trading it can confer several advantages.

Diversification

As a commodity, Brent crude has little to no correlation to the equities market, making it a good candidate for diversifying a portfolio that is overly focused on company shares. Even though it has been observed that a rise in oil prices is commonly followed by a recession, there is little to no evidence to suggest that oil prices have a strong impact on the economy.

Inflation hedge

Crude oil has its own intrinsic value that is not linked to currencies. This renders the commodity resilient against inflation. Even if currencies should fall due to inflation, crude oil is capable of retaining its value, providing investors with a way to hedge against inflation.

Safe haven asset during market downturns

Brent crude can act as safe haven assets during periods of market turmoil and economic downturns. While Brent crude oil can be affected by demand levels, it is ultimately an irreplaceable resource, and thus, capable of retaining value.

Looking for insights into safe haven assets? Dive into the Vantage Markets podcast to explore the intricacies of safe haven assets. Click here to listen now.

Potential for speculation

As seen during the oil crises of the 1970s, crude oil prices can be highly volatile. This creates opportunities for investors to lay speculative bets to potentially make returns from drastic price changes. Depending on the strategies you deploy, crude oil trading can be potentially high risk but may also provide high rewards.

Open a live account with Vantage and start trading oil contract for differences (CFDs) to participate in trading on the price fluctuations of Brent Crude, seizing opportunities whether the market trends upwards or downwards

Historical trends of the Brent crude oil market

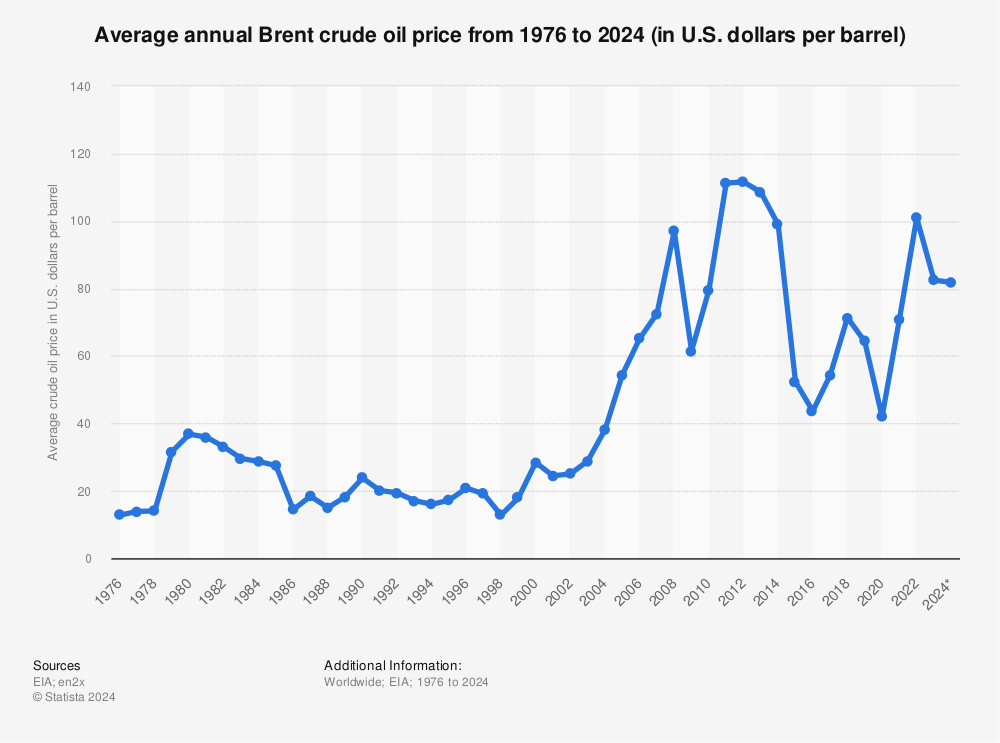

The chart above shows the average price of Brent crude oil from 1976 to 2023, in US Dollars per barrel.

As you can see, Brent crude oil price is highly volatile, despite it being a global benchmark referenced by nearly 80% of the crude oil market [6].

Let’s zoom in on a few recent high-volatility periods to understand what’s going on.

2004 to 2008 [7]

Prices of Brent crude rose quickly between 2004 and 2008, breaking previous price records and hitting almost USD 100 per barrel at its zenith. However, the trend quickly reversed in the second half of 2008.

Prices started rising quickly due to a combination of increased global demand and the inability of oil producers to ramp up production at a commensurate pace. In essence, this was a mismatch between demand and supply.

Why oil producers were unable to keep up with demand was due to the complicated nature of crude oil extraction, production, storage and distribution. Increasing oil production capacity requires significant investments in infrastructure and capital costs, and a substantial amount of time to manufacture, install and bring facilities on line.

In addition, a series of events involving worker strikes, militant attacks, depletion of oil fields, legal battles and the aftermath of the Iraq war created further disruptions and a strain on supply.

This dramatic, multi-year rise came to a sudden stop in mid-2008, which was, of course, the year of the Great Recession, caused by the collapse of the US housing market and the ensuing global downturn.

With demand quickly evaporating, prices of Brent crude suffered a near 40% drop by 2009.

2014 to 2016 [8]

After the 2008 Great Recession, oil prices recovered and set a new high yearly average prices in 2011 and 2012. Prices moderated further until 2014, when a sudden and sharp decline would take place, lasting till 2016.

So, what happened then? Well, the world was sitting on a growing glut in oil supply, which means cheaper oil prices were on the horizon. But the expected economic growth failed to materialise, flooding the market with an oversupply of oil.

There were a number of factors that drove the collapse, including:

- Booming shale oil production in the US. Rising efficiency gains lowered breakeven prices significantly, making US shale oil much more competitive on the international oil market.

- Weakening oil demand. The boom in US shale oil production coincided with weakened demand for crude oil, adding further downwards pressure on price. This was primarily attributable to economic slowdowns in oil importing economies including the United States, China and non-oil commodity exporting emerging markets between 2015 and 2016.

- Price forecast downgrade. Long-term price forecasts had been continually downgraded over the preceding few years,contributing to further price pessimism. Reasons included the potential for further gains in shale oil production, an accelerated uptake of more fuel-efficient technologies, and policies supporting renewable energies.

2020 to 2022

From 2020 to 2022, average crude oil prices went from USD 41.96 per barrel to USD 100.93 per barrel [9]. In 2020, the rise of disagreements between oil-producing countries rose, and a fall in consumer demand due to COVID-19 produced an unprecedented low in oil prices. This led to underinvestment in oil production facilities.

However, as demand for oil quickly recovered, a list of supply constraints appeared due to several factors, including lockdown-induced supply chain issues, the Russian-Ukraine war, and harsher winters leading to greater oil demand All these factors made for the perfect storm, driving oil prices sharply upwards over the next two years.

Brent Crude Oil prediction

As at December 2023, analysts have expressed caution towards crude oil price recovery in 2024. This is despite planned production cuts from OPEC, the impact of which is expected to be offset by resilient non-OPEC supply and slower-than-expected consumer demand. Based on a survey of 30 analysts, crude oil price is expected to be priced around USD 84.43 per barrel in 2024 [10].

There could be further instability ahead. Due to the ongoing Gaza Strip crisis, there is a heightened threat of war in the Middle East. This could severely disrupt oil supply and drive up oil prices, creating further shocks to global economic recovery, and kicking off another cycle of high inflation [11].

What affects Brent crude oil prices? [12,13]

From the events discussed in the previous section, we can glean that Bent crude oil prices are affected by supply and demand levels, macroeconomic factors and geopolitical issues.

Supply and demand levels

It should be intuitive that as demand for oil increases, or as supply falls, Brent crude price should rise, and vice versa. However, this is often not so because, as mentioned earlier, the vast majority of crude oil trade takes place on the futures market,

Here, oil is traded via future contracts – binding agreements that gives one the right to purchase oil by the barrel at a predefined price on a predefined future date. Under a futures contract, buyers and sellers are obligated to fulfil their side of the transaction on the specified date.

This means the relationship between supply/demand and price may (and often do) diverge from expectations. For instance, in early 2020, oil producers around the world agreed to historic production cuts to stabilise prices, but to no avail. Driven by COVID-19 economic slowdowns, crude oil prices fell to a 20-year low.

Crude oil prices are also sensitive to market sentiment, which, again, is exacerbated by the mechanics of futures contracts. Should there be belief that oil prices will rise, traders and speculators rushing in to buy up futures contracts at high prices can bring about a price spike. The opposite is also true.

Hence, while supply and demand remains a fundamental driver of Brent crude oil prices, be aware that the customary behaviours may not apply.

Macroeconomic factors and geopolitical issues

Given the ubiquitousness of crude oil by-products, and how closely oil is intertwined with the global economy, it is to be expected that Brent crude oil prices are heavily influenced by macroeconomic factors and geopolitical issues.

At the risk of oversimplification, oil drives global growth just as much as economic growth drives demand for oil. One simply cannot exist without the other.

Additionally, geopolitical issues can cause significant impact to crude oil prices. Some of these include:

- War with oil-producing countries or oil-producing regions. One recent example is Russia, whose invasion of Ukraine caused the international community to impose economic sanctions. As the country is the third-largest producer of oil in the world, oil prices initially surged on the expectations of a reduction in supply.

- Cartel actions. The Organisation of Petroleum Exporting Countries (OPEC) is a group of 13 oil-producing countries that together control 40% of the world’s oil’s output. OPEC is widely recognised as the largest influencer of oil prices, with the organisation raising or cutting production to exert control over the market.

- Government policies. Green initiatives that mandate a reduction of oil and gas usage by industries could drive down demand for oil. This may cause oil producers to reduce supply in response, which may result in a price spike during periods of high demand, such as during winter.

Types of Brent crude oil trading

While the majority of Brent crude oil trading is conducted on the futures market, futures contracts are complicated and come with high risk, and may only be suitable for highly advanced or experienced investors.

Less experienced retail investors wishing to access trading opportunities in the oil markets may find it helpful to use less complex instruments such as ETFs, stocks or CFDs.

Oil Exchange-traded Funds (ETFs) [14]

Crude oil ETFs are investment funds that track the performance of a basket of stocks, indices or other instruments in the crude oil market. These ETFs typically include entities involved in various aspects of the crude oil industry, including prospecting and extraction, production, distribution, and retail of crude oil and petroleum by-products.

There may also be some commodity pools structured as ETFs, which have limited partnership interest instead of shares. These ETFs invest in derivatives such as oil futures and oil options.

Through an online broker, investors can buy, own or sell oil ETFs as part of their trading strategy to potentially profit from market opportunities.

As oil ETFs track multiple assets at once, they offer broad exposure to the oil markets, and are generally more suited towards investors with longer timeframes. Traders who seek to capture short-term opportunities in quick trades may find more satisfaction with oil CFDs, discussed below.

Oil and energy stocks

If you prefer to trade specific companies involved in the crude oil supply chain, you can look into trading oil and energy stocks via an online brokerage. Just like with oil ETFs, you can choose from a variety of companies and entities at all stages of the crude oil cycle, from discovery to extraction, refinement and distribution.

There may also be opportunities in related sectors such as petrochemicals and petroleum by-products such as plastics, and these related sectors may be worth a look for investors.

One drawback of trading oil and energy stocks is the requirement to purchase and own individual shares of companies. This may require a substantial capital investment. For a less capital-intensive alternative, consider exploring oil CFDs, which will be discussed next.

Oil Contracts-for-Difference (CFDs)

The inherent volatility of crude oil prices make the commodity attractive to investors and traders pursuing short-term strategies. One way to access opportunities in the oil markets are with CFDs, which are financial contracts used to trade on the difference in oil prices between the point when the contract is opened, and the point at which it is closed.

Essentially, Oil CFDs allow you to trade on the price movement of Brent crude over a timeframe of your preference, without having to take physical ownership of the underlying asset.

How to trade Brent crude oil

Looking to trade Brent crude oil? Follow here’s a step-by-step guide to get you started.

Start Brent crude oil trading

1. Open a live account

Firstly, sign up for a Vantage trading account. You will need to open a Live account to trade Brent oil CFDs.

Follow the on-screen instructions to apply for your trading account. Once your account has been approved, you may fund your account in order to start trading.

2. Decide which Brent crude CFD you will trade.

Vantage offers two types of Brent crude CFDs, as follows:

- Brent Crude Oil Cash CFD. This allows you to trade on the spot price of Brent crude in real time.

- Brent Crude Oil Future CFD. Choose this CFD if you wish to try trading on price movements in the Brent oil futures market. Do be aware that oil futures are more complex and may be better suited to experienced or advanced traders.

3. Research and analyse the Brent crude oil market

Except for the very lucky, no one can trade successfully without understanding what’s going on in the market. It is essential to research and analyse the Brent crude market to learn its characteristics and how it works.

This will help you make more informed bets when trading oil CFDs and potentially improving your outcomes.

4. Build Brent crude trading strategies

As your knowledge of the Brent crude oil market grows, and you get a better grasp of your trading style and preferences, you should start building your own set of trading strategies.

Doing so will help you streamline your investing decisions and sharpen your ability to identify and focus on opportunities in the Brent crude market.

Trade Brent crude oil using fundamental analysis [15,16]

Fundamental analysis is the practice of analysing an asset by looking into the relevant factors that surround it. For a commodity like Brent crude, fundamental analysis would entail keeping track of the macroeconomic and geopolitical developments that impact oil production and prices.

As a recent example, tensions sparked off in the Middle East due to a Hamas militant strike on Israel on 7 October 2023. This touched off fears of an oil supply reduction, driving prices up as a result. The following Monday, Brent crude oil rose by 5.5% to USD 88.95 a barrel, from the opening of USD 86.42.

Note that price spike took place in spite of neither of the two combatants being serious oil producers, with Israel owning two oil refineries with an estimated production capacity of 300 barrels per day. While oil supplies were not directly threatened by the conflict, there were worries that the United States, Iran and other players in the Middle East could get drawn in and change the equation.

The Brent crude market can be sensitive towards economic news in important economies. Earlier in 2023, when Silicon Valley Bank in the United States collapsed under the weight of prolonged high interest rates, Brent crude tumbled by 5%, with prices falling below USD 80 per barrel for the first time in two months.

The collapse of the bank had deepened worries about the health of the US economy, and fears of further tightening and unfavourable economic policy changes. This drop in sentiment was what triggered the fall in Brent crude.

These incidents demonstrate the close relationship between oil prices and macroeconomic and geopolitical events, highlighting the importance of fundamental analysis in oil trading.

Trade Brent crude oil using technical analysis

Technical analysis relies on data and indicators on a price chart to discern patterns, and gauge how likely a price trend may continue.

Practitioners of technical analysis often laud the practice for facilitating the trader to strip out market noise and focus purely on price action. They believe that everything of relevance is already “priced in”.

However, while technical indicators are no doubt useful when applied skillfully, they are based on past prices, and thus, “lagging”. At the end of the day, technical indicators are merely tools, and like all tools, they cannot be infallible 100% all of the time.

Here’s an example of how to perform technical analysis on Brent crude oil prices, using two popular indicators – 3EMA and RSI.

The screenshot above shows a price chart of Brent crude oil, indicating a period spanning August to December 2023.

The red and green candlesticks make up the price chart. Superimposed over is the Triple Exponential Moving Average (3EMA), indicated by the green (20-day), yellow (50-day) and red (200-day) lines.

In the bottom half of the screen is the Relative Strength Index (RSI). Let’s discuss each of these indicators in turn.

3EMA for Brent crude oil trading

A moving average filters out noise by creating a constantly updated average price for Brent crude. This allows traders to discern or confirm price trends, while also indicating areas of support and resistance. Moving averages may be simple or exponential – the latter places more emphasis on recent prices.

In the 3EMA, three moving averages of various time periods are plotted – 20-day, 50-day and 200-day – and the interplay between the three lines are used to determine bullish or bearish trends.

When a faster EMA crosses under a slower one, a bullish trend is indicated. The reserve is also true; when a faster EMA crosses over a slower one, a bearish trend is indicated. Moving averages can work with just a pair of averages (one faster, one slower), but the inclusion of a third, longer-lasting moving average allows for a stronger confirmation of the forming trend.

Returning to the screenshot, we can see in November, that the green moving average crossed over both the yellow and the red moving averages, indicating that a bearish trend is well and truly underway.

This bearish trend will likely continue until the green moving average starts moving upwards until it crosses under the yellow and red moving averages.

RSI for Brent crude oil trading

The Relative Strength Index (RSI) is used to show when an asset or commodity is over- or under-traded. The index runs from 0 (minimum trading) to 100 (maximum trading), and usually has 30 and 70 as customary cut-off points.

This means that when the RSI is under 30, this indicates under-trading, and thus, the price at the time is likely to be reasonable. If the RSI is over 70, this indicates the asset is over-traded, and the price is likely to be too high as a result.

Here’s the screenshot of Brent crude oil prices again. The RSI is in the bottom-half of the screen. The Index proper is the purple line, and the yellow line is the RIS moving average.

Pay attention to the purple rectangle in the RSI. Notice how there was an extended period where the RSI was over 70, indicated by the green-shaded bit in the upper left corner of the rectangle?

This was unusual, as in the weeks prior, the 70 RSI had barely been breached. It indicated that Brent crude was overpriced at that point; this is confirmed by the price chart, which was bouncing around a new high.

Judging by the RSI, long positions should be avoided at that point in time. Indeed, soon after, the price of Brent crude oil plunged to its previous low over the span of a week.

Risk management when trading Brent crude oil

Brent crude is a highly volatile commodity with many wild price swings seen throughout history. The complicated relationship it shares with macroeconomic forces and geopolitical events further make it more difficult to predict which way things will go. Hence, it is crucial to implement proper risk management measures when trading oil commodities.

Investors should consider the following:

Proper trade sizing

The allure of fast gains can be intoxicating, tempting a trader to make a larger bet in the hope of a larger payoff. This is highly risky and can lead to poor outcomes with Bent crude commodities. Investors should be disciplined and stick to an appropriately sized trade each time.

As a general rule, each trade should risk no more than 1% to 2% of your capital, reducing as your account size grows [17].

Caution when using leverage

Oil CFDs are a popular way to trade Brent crude. CFDs may be traded on leverage, which means you can put down a smaller capital to trade, and receive amplified returns should your trade goes your way.

However, if your trade goes against you, your losses will also be amplified by the same degree, and this can make your losses exceed your starting capital.

So while leverage allows you to potentially capture significant gains from crude oil market opportunities without needing to invest a large sum upfront, it is also a double-edged sword that can enlarge your losses. Hence, it is important to use leverage with caution, and only when you have built up enough experience have a good grasp of the extent of the losses you may face.

Setting stop-losses and take-profits levels

Traders should also consider using tools to help in their risk management. Two such popular tools are stop-losses and take-profits, which are predetermined points on a price chart at which you will close your trade.

This will help you manage your risk by limiting your losses, or closing a profitable trade in a timely manner instead of risking having your gains wiped out by a reversal.

Brent crude oil trading strategies

Earlier we mentioned that you should build your own set of trading strategies as you learn and hone your skills as a Brent crude oil trader. This is to help you instil discipline in your trading, by learning to play within the rules.

Here are some common Brent crude oil trading strategies:

Day trading

Day trading is focused around making extremely short-term trades that can range from just a few minutes to several hours. Rarely do day traders not hold Brent crude trades overnight.

The aim is to make a relatively large volume of short and long trades to capitalise on Brent crude price action throughout the trading day, with the aim of making profits from very short-term price movements. Day traders may also make use of leverage to amplify their results, but note that leverage will increase both profits and losses.

Position trading

A trading strategy that is opposite to day trading, position trading involves holding a position in the Brent crude market, over a long time frame. The goal is to make a profit when the market moves in a favourable direction.

Position traders may use both long and short positions to hedge against risk and to expand the range of trading opportunities in the crude oil market. This strategy is well-suited to a variety of Brent crude instruments, including stocks, shares and ETFs, besides the commodity itself.

Swing trading

Swing trading is a trading strategy that attempts to trade price swings over several days or weeks. Like day trading, this involves speculating on expected Brent crude price movements based on market sentiment, macroeconomic news or geopolitical events.

Unlike day trading, however, swing trading has a less intensive pace, as Brent crude trades are kept open for significantly longer durations, until a significant portion of the swing is captured.

Read our guide on “Position Trading vs Swing Trading” to help you understand them better.

Trend following

Trend following or trend trading is a simple idea at its core: Trade with the trend, and not against it. This means choosing short or long positions in accordance with the overall price trend that is happening in the Brent crude market.

The challenge in trend following is learning how to correctly identify the current price trend, determining how long this trend is likely to last, and being able to recognise when the trend has ended its run.

Trend traders make use of an array of technical indicators on a price chart to gauge trend momentum and direction. Read our article on trend analysis guide and learn how you can implement this technical analysis technique to your trades.

Sentiment trading

As per its name, sentiment trading is a trading strategy based upon market sentiment towards Brent crude oil prices. When the outlook is good, and prices are expected to rise, a sentiment trader may decide to open a long position to potentially capture profits. When the outlook turns negative, a sentiment trader may decide to use short-selling instead.

The volatile nature of the Brent crude oil market makes it challenging to use sentiment trading correctly. Traders should focus on filtering out noise and attempt to get a pure read on market sentiment as much as possible.

News trading

News trading is similar to sentiment trading, in that trades are made as news events are announced. The type of news referenced may range from earnings reports by Brent crude oil companies, to political announcements such as elections, and economic reports like inflation readings and employment levels.

To be successful, a news trader must be able to evaluate relevant news reports and form the correct theories to support the trades they make.

Brent crude oil trading hours

The trading hours for Brent crude depends on the instrument chosen. Brent futures trading hours follow that of the exchange on which they are offered, whereas instruments such as CFDs, stocks and ETFs are available for trade according to the online brokerage you choose.

Brent crude futures trading hours on Intercontinental Exchange Inc (ICE) [18]

| City | Trading hours | Pre-open |

| New York | 8pm to 6pm (next day) | 7.45pm |

| London | 1am to 11pm (next day) | 12.45am |

| Singapore | 9am to 7am (next day) | 8.45am |

On Sundays, pre-open is at 10am and markets open at 11am onwards, London local time.

Brent CFDs

Vantage offers trading to Brent CFDs during the following time periods:

| Description | Symbol | Trading time (GMT+2) |

| Brent Crude Oil Cash | UKOUSD | Monday:01:00-24:00 Tuesday – Friday:03:00-24:00 |

| Brent Crude Oil Future | UKOUSDft | Monday:01:00-24:00 Tuesday-Friday:00:00-01:0003:00-24:00 |

Key takeaways for Brent crude oil trading

As one of the most important and actively traded commodities, Brent crude offers many opportunities for traders and investors. However, the market is highly volatile, as prices are sensitive to geopolitical events, macroeconomic developments and market news.

That the majority of Brent crude is traded via futures contracts can further exacerbate things, as the market may take reference from futures contracts, amplifying sentiment changes and trend swings.

The more advanced forms of Brent crude trading such as futures and options may not be suitable for inexperienced investors unprepared for the volatility that is often present in the market.

Investing in Brent ETFs or stocks and shares of companies involved in the Brent crude supply chain may be a more manageable option for beginners, as would having a longer investing time horizon.

But for those who are willing to invest the time and effort to meet the demands of Brent crude trading, there is perhaps no other commodity that offers as much excitement and potential.

Trade Brent crude CFDs with tight spreads at Vantage

Vantage offer tight spreads starting from 0.0, allowing you to trade Brent crude via CFDs at minimum cost. There are also no deposit fees, monthly rollover fees and other hidden fees imposed.

Pick from MT4, MT5 and Vantage mobile app, each packed with powerful features that allow you to react instantly to the latest developments and trade on the go. Deploy long and short strategies to potentially capture gains no matter which way the market goes, and manage risk with our array of flexible tools.

Trade Brent crude via CFDs with Vantage and experience the difference. Sign up now and enjoy a deposit bonus* to boost your first trade!

Terms & Conditions apply*.

Frequently Asked Questions (FAQs)

Q1. What is the spread on Brent crude oil assets at Vantage?

We offer tight spreads for Brent CFDs, starting from as low as 0.0. Trade at minimum cost with Vantage.

Q2. What are the risks of Brent crude oil trading?

Brent crude oil prices are highly volatile, which is the main risk factor facing investors and traders. As the main benchmark for the world’s most important commodity, Brent crude can be impacted by a wide number of events, news, developments and factors, some more apparent than others. Wild price swings are not uncommon in Brent historical prices.

Proper risk management must be practised when trading Brent crude oil. Investors should also expect to invest substantial time and effort in studying and understanding the market, and be prepared to be proven wrong at any time.

Q3. Why is Brent oil more expensive than WTI crude oil?

Because both Brent crude and WTI crude share similar characteristics as sweet and light crude oils, their prices are strongly correlated. However, due to differences in extraction locations, transportation and exchange listings, the price of Brent and WTI may show divergence at times, putting one higher than the other.

In other words, it is not always true that Brent oil is more expensive than WTI crude oil, as the reverse has also happened before. Importantly, both commodities may react differently to the geopolitical and local economic forces.

Q4. What are the additional tips for trading Brent crude oil?

The Brent crude markets can undergo wild price swings that may be hard to see coming. Thus, traders should arm themselves with the means to easily track important market news and developments, and the ability to react quickly to take advantage of upcoming opportunities.

This means choosing an online brokerage that offers fast, reliable connectivity and feature-rich trading platforms with an array of flexible and powerful tools, so as to be better able to trade effectively in the fast-paced Brent crude oil markets.

Q5. What is the difference between Brent crude oil and WTI crude oil?

The main difference between Brent crude oil and WTI crude oil is the extraction location.

Brent crude oil refers to a blend of light and sweet crudes extracted from the North Sea region, which is part of the Atlantic Ocean and northern Europe. WTI crude oil is extracted from fields in the United States, namely Texas, North Dakota, and Louisiana.

The difference in extraction location between the two has led to alternative names – European crude for Brent, and American crude for WTI. There are also differences in storage, transportation and distribution, due to the different nature of both extraction regions.

Additionally, while Both Brent crude and WTI crude are classified as light and sweet crudes, there are slight variations between them in terms of density and sweetness.

Learn all about their differences here.

Q6. Can I practise Brent crude oil trading?

Yes. Traders and investors wishing to practise Brent crude trading and test out trading strategies on paper may do so by signing up for a free Vantage demo account. There are no fees or minimum deposit required to practise Brent oil trading with a demo account.

References

- “Energy Investing Basics: WTI vs. Brent Crude Oil – Charles Schwab” https://www.schwab.com/learn/story/energy-investing-basics-wti-vs-brent-crude-oil Accessed 5 April 2024

- “BrentTM the world’s crude benchmark – ICE” https://www.ice.com/insights/market-pulse/brent-the-worlds-crude-benchmark Accessed 5 April 2024

- “The North Sea—A Long and Proud History – TheWayAhead” https://jpt.spe.org/twa/the-north-sea-a-long-and-proud-history Accessed 5 April 2024

- “North Sea Brent Crude: Meaning, Investing, History – Investopedia” https://www.investopedia.com/terms/n/northseabrentcrude.asp Accessed 5 April 2024

- “How Oil Prices Affect the Stock Market – Investopedia” https://www.investopedia.com/ask/answers/030415/how-does-price-oil-affect-stock-market.asp Accessed 5 April 2024

- “Navigating Oil Price Risk – ICE” https://www.ice.com/insights/market-pulse/navigating-oil-price-risk Accessed 5 April 2024

- “The 2008 Oil Price Shock: Markets or Mayhem? – Resources.org” https://www.resources.org/common-resources/the-2008-oil-price-shock-markets-or-mayhem/ Accessed 5 April 2024

- “What triggered the oil price plunge of 2014-2016 and why it failed to deliver an economic impetus in eight charts – World Bank Blogs” https://blogs.worldbank.org/en/developmenttalk/what-triggered-oil-price-plunge-2014-2016-and-why-it-failed-deliver-economic-impetus-eight-charts Accessed 5 April 2024

- “Average annual Brent crude oil price from 1976 to 2024 – Statista” https://www.statista.com/statistics/262860/uk-brent-crude-oil-price-changes-since-1976/ Accessed 7 April 2024

- “POLL Economic risks to stifle oil’s gains in 2024 despite OPEC+ cuts – Reuters” https://www.reuters.com/business/energy/economic-risks-stifle-oils-gains-2024-despite-opec-cuts-2023-11-29/ Accessed 5 April 2024

- “Oil Price Shock Would Hit 2024 Growth and Boost Inflation – FitchRatings” https://www.fitchratings.com/research/sovereigns/oil-price-shock-would-hit-2024-growth-boost-inflation-10-11-2023 Accessed 5 April 2024

- “What Determines Oil Prices? – Investopedia” https://www.investopedia.com/articles/economics/08/determining-oil-prices.asp Accessed 5 April 2024

- “Oil Market and Russian Supply – IEA” https://www.iea.org/reports/russian-supplies-to-global-energy-markets/oil-market-and-russian-supply-2 Accessed 5 April 2024

- “Oil ETF: What It is, How it Works, and Challenges – Investopedia” https://www.investopedia.com/terms/o/oil-etf.asp Accessed 5 April 2024

- “Brent climbs 5.5% amid Middle East tensions – Economies.com” https://www.economies.com/commodities/brent-oil-news/brent-climbs-5.5-amid-middle-east-tensions-43493 Accessed 5 April 2024

- “Brent falls below $80 for the first time in two months following the collapse of Silicon Valley – Economies.com” https://www.economies.com/commodities/brent-oil-news/brent-falls-below-$80-for-the-first-time-in-two-months-following-the-collapse-of-silicon-valley-42532 Accessed 5 April 2024

- “Risk Management Techniques for Active Traders – Investopedia” https://www.investopedia.com/articles/trading/09/risk-management.asp Accessed 5 April 2024

- “Brent Crude Futures – ICE” https://www.ice.com/products/219/Brent-Crude-Futures Accessed 5 April 2024