Understanding when to trade is important in finding success as a trader. This is especially so for forex trading, owing to the time sensitivity of the foreign exchange markets. This is because there are specific bands of times throughout the day which offer traders optimal trading opportunities. Outside of these timebands, however, potential for profitable trades tend to be muted.

This is a property unique to the forex markets, but before we get into the exact reasons why, it is important to first understand what forex trading is.

Simply put, forex stands for foreign exchange, which is the exchange of one currency for another for the purpose of trade or tourism.

The exchange rate between pairs of currencies do not remain fixed, they fluctuate over time, sometimes by quite a bit. This fluctuation is what forex traders utilise to potentially capture profits from the foreign exchange markets. For more details, read our forex beginners guide.

Key Points

- Forex trading sessions are specific periods during the day when trading activity is heightened due to the operations of major financial centres around the world, leading to increased market volatility and liquidity.

- The most significant forex trading overlaps occur during the New York and London sessions, where about 70% of all forex trades happen, offering the highest liquidity and trading opportunities.

- Optimal times for trading specific currency pairs are during their respective major market sessions, which align with the business hours of their primary financial centres, ensuring high market activity and liquidity.

Understanding Forex Market Hours

As mentioned, forex trading hours are important for forex trading to pay attention to. This is because while the forex markets are open 24 hours on weekdays, trading activity tends to congregate during times when major financial centres around the world are active.

The trading activity carried out by banks and corporations – which are the real market movers – prompt an increase in volatility and liquidity. This also attracted more forex speculators to come online.

Why is volatility important to forex traders? Because it is the mechanism by which traders can make potential profits (or losses).

You see, when you trade forex, you are making bets on one currency strengthening against another, by taking long (to buy) or short (to sell) positions. If the currency pair moves in the direction you picked (long or short), you will reap a profit. The larger the difference, the larger your profit (or loss, if the currency pair went against the direction you picked).

This means that traders can potentially profit when the markets are moving up, or when they are moving down. But when the forex market is moving neither up nor down, traders will be hard pressed to find any meaningful trading opportunities.

In practice, this means that forex traders should pay attention to the peak periods of trading activity taking place in financial centres around the world, and time their trades accordingly.

Global Forex Market Sessions [1]

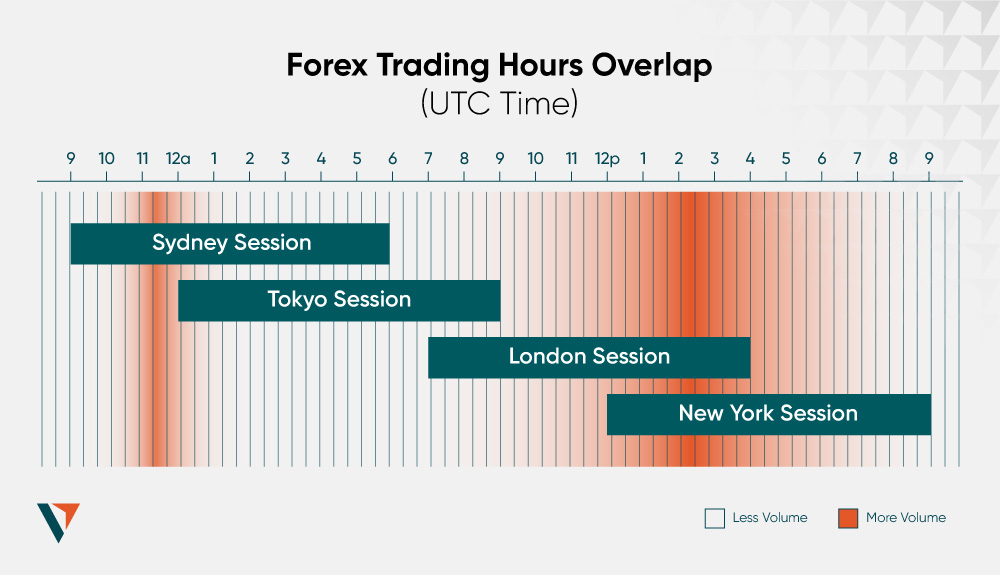

The global forex market can be split up into four major trading sessions, according to the market hours of four of the world’s most important financial centres. These are the Sydney, Tokyo, London and New York sessions.

Out of these four major trading sessions, there are traditionally three peak forex trading sessions: the Asian (Tokyo), European (London) and North American (U.S.) sessions. This is popularly known as the Forex 3-session System.

Opening and Closing Times of Major Forex Market Sessions Around the World [2]

| Session | Local time | UTC |

| Sydney | 7am to 4pm | 9pm to 6am |

| Tokyo | 9am to 6pm | 12am to 9am |

| London | 8am to 5pm | 7am to 4pm |

| New York | 8am to 5pm | 1pm to 10pm |

As you can see, forex market sessions are not fixed across the world. Each region’s market opening and closing hours are based on local business hours, which may vary according to prevailing customs and events such as major holidays. Note that markets are closed on Christmas and New Year’s Day.

Daylight Savings Time and Forex Trading Sessions

Forex trading sessions are affected by Daylight Savings Time (DST), which is instituted during March/April, and October/November. This means that forex markets in the affected regions (Europe, United States, New Zealand and Sydney) will open and close earlier or later than during non-DST.

Note that UTC in the chart above ignores DST. It may be more helpful to use local times as your point of reference when trying to determine the corresponding market trading hours in your own timezone.

Making use of an online timezone convertor is recommended to help you pin down the right forex trading sessions.

Trading Session Overlaps [3]

You may have also noticed that there are overlaps among the three peak trading sessions, happening on a daily basis.

The following graphic will help you visualise these overlaps.

Trading session overlaps are considered prime forex trading sessions. When two forex markets are active at the same time, trading activity tends to shift into overdrive, resulting in greater price movements, higher trade volumes and increased liquidity.

Let’s take a closer look at the characteristics of the three forex trading session overlaps.

New York and London overlap (1pm to 4pm UTC)

This is the most significant overlap of the three, typically featuring the heaviest volatility and highest liquidity. During the New York and London forex trading sessions overlap, over 70% of all forex trades take place. This is due to the USD and the EUR being two of the most popular currencies to trade.

As such, this is the most popular trading period for most forex traders who are interested in trading pairs like USD/EUR, or EUR/GBP.

Sydney and Tokyo overlap (12am to 6am UTC)

The Sydney/Tokyo fires session overlap is generally less volatile than the previously discussed overlap, but it still offers some robust trading opportunities. The main currencies affected are EUR and JPY, which means traders of EUR/JPY would typically be active during this time period.

London and Tokyo overlap (7am to 9am UTC)

This is the shortest overlap of the three, and also usually sees the least action. This is due to the odd hours, and the low likelihood of large fluctuations occurring within the 2-hour time frame.

Trading Strategies for Overlap Hours

As previously stated, session overlap hours are highly sought after among forex traders, due to increased volatility and higher liquidity. During these time periods, forex trading activity can speed up, prompting traders to deploy short-term trading strategies to make the best of it.

Some short-term forex trading strategies that rely on quick trades include:

Day trading

In this strategy, forex positions are held from a few hours to less than a day – but never overnight. This is to avoid overnight risk, where unexpected events or developments may cause a price gap to form while the markets are closed.

Discipline should be maintained to tamp down the risk of emotional trading decisions leading to costly mistakes.

Breakout trading

Breakout trading looks for trading opportunities that occur just before a price “breaks out” from a previously established range. The idea is to enter the market just before the breakout and then continue to ride the trade until volatility dies down.

Due to how it works, this strategy is well-poised to take advantage of the increased volatility present in forex markets during session overlaps. The downside is it takes solid skills and experience to properly identify a breakout, and beginners may find success elusive with the strategy.

Practise Risk Management When Trading Session Overlaps

Due to heightened volatility, the forex markets offer increased potential for profit during overlap sessions. But the wild swings in the prices of currency pairs can also mean a bigger loss should the trade go against you.

This is further complicated by the use of leverage, which is common in forex, given that trades typically involve very small movements in the price of the currency pair. As you are probably aware by now, leverage amplifies your trading outcome, whether profits or losses.

The bottomline is, when trading during overlap sessions, it is crucial to practise proper risk management. Be sure to follow a trading plan, choose your trading strategies wisely, adopt proper trade sizing and resist the temptation to ignore predefined limits and rules.

Best times to trade forex

During High Liquidity

One of the best times to trade forex is when there is high liquidity in the market. As discussed earlier, the New York/London overlap session is when the forex market tends to have the highest liquidity. Thus, many forex traders focus their efforts during this timeband.

To understand why, let’s take a look at what liquidity is, and how it impacts the market.

Liquidity is a measure of how easily and efficiently a currency pair can be bought or sold without causing drastic price fluctuations. It indicates the depth and availability of market participants, and how able or willing they are to execute trades promptly at competitive prices.

Now, “competitive prices” means a price that is closest to the perceived value of the asset being sold. For instance, if a stock perceived to be worth USD 100, is easily sold at USD 100, we can say the market is at perfect liquidity.

when the forex market is at high liquidity, this means there is a high number of buyers and sellers swiftly executing trades at prices indicative of current market perceptions. Also, the bid-ask spread is tighter, reducing the risk of slippage, which is when the execution price differs vastly from the expected price.

When the forex market is in low liquidity, this means that there are fewer buyers and sellers, making it more difficult for trades to be executed. Slippage is also higher, exposing traders to the risk of settling the trade at a significantly higher or lower price, which can turn a trade from a breakeven into a loss, or widen a loss.

For these reasons, forex traders prefer to trade during periods of high liquidity for their targeted currency pairs.

Currency-specific Best Times

So, what are the best trading times for specific currency pairs?

Generally speaking, currencies are most active during their respective trading sessions. That’s to say, the Yen is most active during the Tokyo session, and thus good pairs to trade then would be currency pairs that contain the Yen.

Since we already know the timings of the three peak forex sessions, we can thus surmise the best trading times for major currencies, as follows:

| Forex session | Timing (UTC) | Most active currencies | Examples of currency pairs to trade |

| Asian | 12am to 9am | JPY, AUD, NZD | JPY/USD, JPY/AUD, AUD/USD, AUD/EUR |

| European | 7am to 4pm | GBP, EUR, CHF | GBP/USD, EUR/CHF, USD/CHF, GBP/JPY |

| North American | 12nn to 9pm | USD, CAD | EUR/USD, USD/CAD, EUR/CAD |

One reason why the best time to trade a specific currency is during its specific trading session is because the forex market is the largest market in the world, with daily volume reaching USD 6.6 trillion according to the 2019 Triennial Central Bank Survey of FX and OTC derivatives markets. This is far larger than the stock market. [4]

As such, major currency pairs experience high trading activity and deep market liquidity throughout their respective trading sessions.

Of course, we see that liquidity and trading activity peaks during the New York/London overlap, but it bears noting that the US and European sessions remain highly active and far from dead outside of the overlap.

During News Releases

As currencies can be impacted by economic news and developments, forex traders should take note of important news releases, which may create trading opportunities.

Major news announcements can speed up trading activity in the forex markets, and the release of economic results – especially when they go against expectations – cause currencies to gain or lose value quickly.

Given that news reports are released everyday around the globe, forex traders should develop the ability to filter out irrelevant pieces and only focus on important ones. This can be enhanced with the help of an economic calendar that allows you to customise the news you want to track.

Generally, positive news about economic growth leads to a currency strengthening against another, creating a trading opportunity to go long on the pair. Conversely, if news broke that would cause a currency to weaken, it may prove beneficial to go short on the relevant currency pair.

Some examples of significant news events that forex traders should pay attention to include but not limited to:

- Central bank interest rate announcements

- Inflation measures such as Consumer Price Index

- Trade deficits, which translates to more cross-border capital flows impacting exchange rates

- Consumer confidence and consumption level

- Gross Domestic Product, which measures the sum total of goods and services produced

- Unemployment rates, as high unemployment can drag down economic growth, leading to a weaker currency

Read our article, ‘News Trading: A Deep Dive into “Buy the Rumour, Sell the News,”‘ to understand and dissect this strategy’s concept.

Conclusion

Understanding forex trading sessions is key in forex trading, as it helps you to capitalise on periods of high market liquidity and trading activity – crucial to successfully executing your trades with minimal disruption.

The good news is, picking the most suitable trading session is rather straightforward, and most traders can do well just by following the peak trading sessions.

Remember that while the New York/London overlap session has been noted to have the highest activity and deepest liquidity, this also means that volatility is higher. This heightened volatility may not be suitable for every forex trader, and you may well find yourself preferring to trade when the markets are more sedate.

In any case, knowing the major forex sessions and which currency pairs to trade should be fundamental knowledge. You will likely find this useful as you increase your experience and skills as a forex trader.

Frequently Asked Questions (FAQ)

Q. What’s the forex market open timing?

The global forex markets trade 24 hours a day, five days a week. In forex, there are four major trading sessions, as follows:

- Sydney: 9pm to 6am UTC

- Tokyo: 12am to 9am UTC

- London: 7am to 4pm UTC

- New York: 1pm to 10pm UTC

Q. What time is the forex market most active?

The forex market is noted to have the highest activity and deepest liquidity when the London and New York sessions overlap. This takes place from 1pm to 4pm UTC, and it has been observed that roughly 70% of all forex trades take place during this period.

Q. When is the London session in forex?

The London session takes place during business hours on weekdays. In local time, the London forex markets are active from 8am to 5pm. This translates to 7am to 4pm UTC.

References

- “The Forex 3-Session System – Investopedia”. https://www.investopedia.com/articles/forex/08/3-market-system.asp. Accessed 22 April 2024.

- “Forex Trading Sessions – BabyPips”. https://www.babypips.com/learn/forex/forex-trading-sessions. Accessed 22 April 2024.

- “The Best Times to Trade the Forex Markets – Investopedia”. https://www.investopedia.com/articles/forex/08/forex-trading-schedule-trading-times.asp. Accessed 22 April 2024.

- “Forex Market: Who Trades Currencies and Why – Investopedia”. https://www.investopedia.com/articles/forex/11/who-trades-forex-and-why.asp. Accessed 22 April 2024.