A global recession may arrive in 2023. Here’s what you may consider when putting together a recession investment strategy.

Several economists and financial bodies – most recently the World Bank[1] – have put out warnings of a coming global recession. Slated to take place in 2023, how would a recession affect your portfolio, and what are the ways to trade?

An economic downturn can, of course, affect your investment portfolio, but it’s not all bad news. There are ways to lessen its negative impact, and also opportunities to take advantage of the downward price trends, characteristic of this period.

In this article, we will be looking at how a recession can affect your portfolio, as well as discuss things you may consider looking out for when trading during recessions.

Key Points

- Recessions are part of the economic cycle and can lead to heightened market volatility and paper losses in investment portfolios.

- Investors may shift from riskier assets to safer alternatives like gold and government bonds, typically resulting in a price rise for these assets during economic downturns.

- Reduced corporate spending during recessions may lead to job layoffs and income instability, affecting individuals’ capital available for investment.

Understanding economic recessions

Recessions are often spoken about with a general sentiment of doom and gloom, which can be unpleasant or even frustrating for investors.

However, it is helpful to keep things in perspective.

Recessions are a natural occurrence in the economic cycle. They are short-term declines in economic activity against a backdrop of longer-term economic growth.

Since the Industrial Revolution, the dominant trend of the majority of countries is long-term economic growth. However, along the way, events and occurrences such as war, natural disasters, supply disruptions, market corrections, inflation, or a pandemic (such as COVID-19) can interrupt macroeconomic growth.

This brings about a slowdown – or in severe cases, a contraction – in the economy. Importantly, this is closely followed by a fall in the stock market, which can have several implications, as discussed in more detail below.

The widely accepted definition of a recession is two consecutive quarters of economic decline in a designated country, geographic region or globally, paired with other factors such as an increase in unemployment.

This well-worn definition, however, is giving way to a more nuanced interpretation. According to the National Bureau of Economic Research in the US, a recession can be seen as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales[2].

Navigating the Psychological Landscape of Recession Investing

Investing during a recession can feel like navigating a stormy sea. Emotions run high as market volatility tests even the most seasoned investors’ resolve. Understanding the psychological landscape is crucial for making sound decisions amidst economic downturns.

It’s not just about analysing numbers and trends; it’s about recognising how fear, overconfidence, and herd mentality can skew our perception and decision-making processes. By acknowledging these psychological factors, investors can develop a more disciplined approach to manage their portfolios during challenging times.

Panic Selling

One common emotional pitfall is panic selling — a knee-jerk reaction to sudden market drops. This behaviour is often driven by the fear of losing everything, leading investors to sell their assets at a loss, hoping to avoid further declines.

However, history shows that markets in the long-run, often recover over time. Implementing strategies to combat emotional investing, such as setting long-term investment goals, maintaining a diversified portfolio and having a trading plan, can help investors stay the course and possibly benefit from the eventual market recovery.

Herd Mentality

Another aspect to consider is the herd mentality, where investors follow the crowd into making investment decisions without independent analysis. This can amplify market volatility and lead to poor investment choices.

To navigate the psychological landscape of recession investing successfully, it’s essential to stay informed, rely on credible information, and adhere to a well-thought-out investment plan. By doing so, investors can resist the urge to make impulsive decisions based on emotions and instead focus on their long-term financial health.

Read our article on trading psychology basics to sharpen your strategy and help you navigate market downturns with confidence.

3 ways a recession may affect your investments and trades

Heightened volatility and paper losses

Recessions are difficult because no investor likes to see their portfolio go down in value. Depending on what your actual holdings are, these losses can range from uncomfortable to downright alarming.

Also, it is common to encounter “bull traps” during a market downturn; this is a temporary price recovery, followed by an even greater decline. This heightened volatility creates more anxiety and worry, which in turn leads to repeatedly checking price charts.

A drop in portfolio values can make it seem like all your hard-won earnings are evaporating before you – or, for new investors, make you feel like you’ve made a big mistake.

However, it’s important to remember that these are “paper losses”, you haven’t actually lost any money, until you sell your investments or close out your position[3].

Rotation to alternative asset classes

During a recession, people tend to move from more risky assets to alternative ones. This capital flight is further prompted by falling stock prices, which are brought on by a combination of dimmed outlooks and waning investor confidence in times of economic contraction.

If investors are fleeing the equities markets, where are they parking their funds? Traditionally, gold and government bonds are two of the most popular assets for investors seeking protection against the negative impact of a recession[8].

Investors rotate into bonds because they are less volatile than stocks on average[4], as there is less uncertainty and more knowledge about their income flow.

Meanwhile, gold’s value is propped up due to its dual identities as both a commodity and a reserve asset used by central banks[5].

As such, during a recession, investors will notice that prices of gold and bonds tend to rise while the stock market is in decline.

Read our gold article that covers everything about gold that dives into the intricate dynamics of gold as a good trading instrument.

Lower capital for investing

During an economic slowdown, businesses tend to take a defensive position, with a heightened emphasis on reducing costs. This could take the form of hiring and wage freezes, job layoffs, a decrease in marketing expenditure, reductions in third-party services, etc.

As corporations and employers reduce their spending, workers and those who rely on them for income and revenue face retrenchment, income loss and financial instability.

With less money on hand, there is a possibility of cutting back on investments or trades investors may have to reduce or halt their investments altogether.

Coming up with a recession investment strategy

Now that you understand how a downturn can affect your investments and trades, you may consider the following adaptations during your trading during a recession.

Consider adding short-selling to your trading strategy

Short-selling or shorting, allows investors to take advantage of market downturns. By shorting a stock, index, sector or asset class, you can create market opportunities should the price of the asset go down.

There are several ways to carry out short-selling, including using Contracts-for-Difference (CFDs). Note that CFDs also allow you to take out long positions, making it a versatile trading tool.

Hunt for value stocks

As mentioned earlier, stock prices tend to plummet during a recession. This essentially allows investors to buy up equities at a discount and create market opportunities down the line.

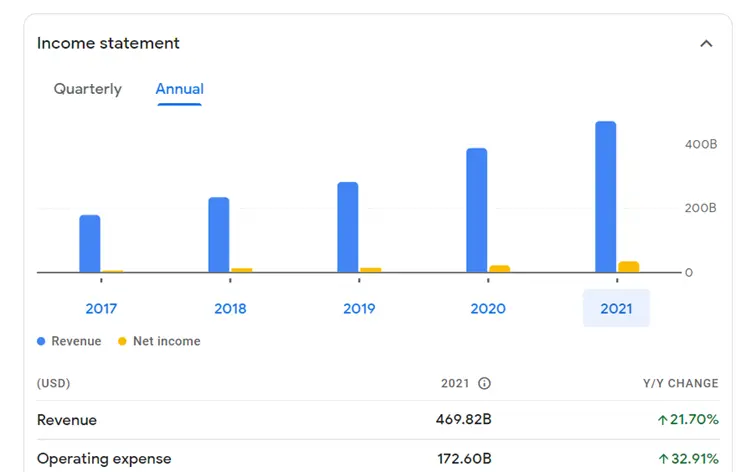

Take Amazon (AMZN) for instance. The stock is down 40% from a year ago at the time of writing, and prices have been trending sideways since May. However, the company’s continued growth in both revenue and net income indicates there is still plenty of room for growth.

Maintain a long-term view

Even though recessions can be arduous, bear in mind that they typically last around six months to a year[7].

This means that while you pay attention to short-term opportunities, you may want to consider blue-chip stocks companies with proven track records as well.

Conclusion: Even in a recession, opportunities could be abound

Market downturns and falling asset values can certainly be hard to stomach. However, having the right understanding, and knowing what steps to take, may help in riding out the storm.

Recessions offer investors a rare chance to buy up stocks at a lower price. The heightened volatility during a downturn also means potential trading opportunities on short-term trades.

CFDs offer a convenient and user-friendly way for traders to open short and long positions, and create market opportunities on price movements in any direction.

Additionally, CFDs are available for a large variety of assets and markets, allowing you to diversify your investments.

Find out more about trading CFDs.

Start Trading with Vantage

Access markets including forex, commodities, indices, shares/stocks and more, at low cost.

Start trading CFD stocks by opening a live account here, or practice trading with virtual currency with a demo account.

You can also sign up for our free, weekly webinars that will break down the current markets as well as discuss potential trade set ups for the week.

Reference

- Fortune, World Bank Warns Of Recession And Stagflation. https://fortune.com/2022/06/07/world-bank-global-recession-inflation-stagflation/. Accessed on 6 July 2022.

- Investopedia, Recession Definition. https://www.investopedia.com/terms/r/recession.asp. Accessed on 6 July 2022.

- Motley Fool, What Is A Loss On Paper?. https://www.fool.com/knowledge-center/what-is-a-loss-on-paper.aspx. Accessed on 6 July 2022.

- Investopedia, Why Stocks Generally Outperform Bonds. https://www.investopedia.com/articles/basics/08/stocks-bonds-performance.asp. Accessed on 6 July 2022.

- Reuters, Why Central Banks Buy Gold. https://www.reuters.com/article/sponsored/why-central-banks-buy-gold. Accessed on 6 July 2022.

- Google Finance, Amazon.com, Inc., https://www.google.com/finance/quote/AMZN:NASDAQ?sa=X&ved=2ahUKEwi-jJD_ufP4AhUjxXMBHQ_VCnsQ3ecFegQIGRAg&window=1Y. Accessed on 6 July 2022.

- CNBC, What To Expect In A Typical Recession. https://www.cnbc.com/2022/06/24/what-to-expect-in-a-typical-recession.html. Accessed on 6 July 2022.

- Investopedia, Safe Haven. https://www.investopedia.com/terms/s/safe-haven.asp. Accessed on 6 July 2022.