In our previous introductory article to forex, it was mentioned that there are over 180 currencies being traded across the global Forex markets, with an average daily volume of USD 7.5 trillion in 2022, making it the largest financial market in the world.

This article will help to paint a clearer picture of the forex markets, as well as the types of currency pairs available for you to trade.

Key Points

- The Forex market is the largest financial market globally, with an average daily volume of USD 7.5 trillion in 2022, where currencies are traded in pairs, such as the major currency pairs which include GBP/USD and EUR/USD.

- Minor currency pairs like EUR/GBP and CAD/JPY have significantly less liquidity and higher volatility compared to majors, while exotic pairs such as USD/HKD involve currencies from emerging markets and carry risks due to potential instability.

- In a currency pair, the base currency is bought while the quote currency is sold; for instance, in the EUR/USD pair, the price indicates how much USD is needed to purchase one EUR, and traders pay the ‘spread’ between the bid and ask prices to enter trades.

What Currency Pairs Are There?

With so many currencies available around the world, there are six that stand out as they represent some of the largest global economies and are traded in high volumes [1]:

- USD (US Dollar)

- EUR (Euro)

- GBP (Great British Pound)

- JPY (Japanese Yen)

- CAD (Canadian Dollar)

In Forex trading, it is usually done with a pair of currencies through the simultaneous buying of one currency and the selling of another. A real-world example of this concept is when an individual travels from the US to the UK, the person must “sell USD” to “buy GBP” in order to spend GBP, the legal tender in the UK. However, in the context of Forex trading, buying or selling a currency pair is not meant for the purpose of exchanging currencies, but rather to anticipate changes in currency prices for a gain.

Currency pairs in forex trading can be split into major currency pairs (“majors”), minor currency pairs (“minor”), and exotic currency pairs.

The five most traded forex currency pairs globally, which are also the major currency pairs [2], are:

“Minor currency pairs” constitute of less popular pairs such as [2]:

- EUR/GBP

- GBP/CAD

- CAD/JPY

- AUD/CAD

- CHF/JPY

The main difference between major and minor currency pairs is the liquidity. Major pairs tend to be more popular which generates high liquidity, meaning major currency pairs can be traded in sizable amounts without huge divergence in exchange rates. On the other hand, minor currency pairs, being less popular, have significantly lower liquidity, leading to higher trading costs and volatility.

“Exotic currency pairs” typically refers to trading of a currency from a developing market with another major currency as the base currency. Traders looking to trade exotic currencies must take into account the extreme movements the markets can bring due to destabilising factors concerning the smaller markets. Examples of exotic currency pairs include [2]:

- USD/HKD (Hong Kong Dollar)

- USD/ZAR (South African Rand)

- USD/THB (Thai Baht)

- USD/NOK (Norwegian Krone)

- USD/SGD (Singapore Dollar)

Understanding Currency Pairs

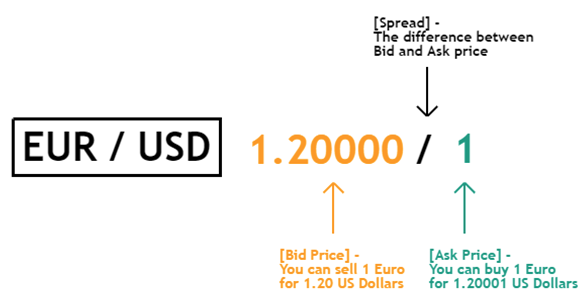

Let us dive deeper into the anatomy of a currency pair. In this example, we will be looking at the major currency pair EUR/USD.

The base currency is what an individual is buying while the quote currency is the currency the individual is selling against.

When a Forex pair is displayed as a quote such as the example above, the price shows how much the quote currency (USD) is required to purchase one unit of the base currency (EUR). Breaking down a Forex quote, the number on the left is called the “Bid price” which is the price traders can buy the currency pair while the number on the right is the “Ask price”, which is the price traders are able to sell the currency pair.

The difference between the bid and ask price is known as the spread, which is the price traders pay to enter a trade on EURUSD. The lower the spreads, the lesser traders must pay to enter a trade. Hence, finding a broker such as Vantage, which offers RAW ECN Forex Trading accounts, allows traders to trade with spreads from as low as 0.0.

Forex Currency Pairs nicknames

Forex market has been active around the world for centuries, leaving behind some amusing currency jargon which are still commonly used in present days. Some currency nicknames come with interesting origins while some are just a play of words. Some of the most popular nicknames are as follows:

Cable (GBPUSD)

Before the invention of modern communication methods, the exchange rate between GBP and USD was transmitted across the Atlantic Ocean via submarine cable. This first of such cables laid was in 1958, from London to New York exchanges.

Fiber (EURUSD)

Euro, being a much newer currency than the Pound, gained the name “Fiber” in around 1999 as traders believed that EURUSD was going to be an upgrade from cables. The nickname was said to be inspired from the lightning-fast fiber optics which superseded the use of cable in the exchanges.

Ninja (USDJPY)

Probably a much cooler nickname than Cable and Fiber with reference to the traditional Japanese ninja warriors, Ninja is an epithet for USDJPY, one of the most traded currency in the world. It is traditionally considered a ‘safe haven’ currency and investors flock towards the Yen in times of economic downturn.

Loonie (USDCAD)

Loon is a common bird featured on the flip side of Canada’s $1 coin, which became such a popular nickname for the Canadian dollar that the Royal Canadian Mint trademarked the name in 2006. USDCAD is one of the major currency pairs and is heavily traded by both traders and institutions all over the world.

Aussie (AUDUSD)

Australians are well known for their habit of nicknaming and abbreviating everything, it’s just natural to refer their own currency as Aussie. The Australian Dollar is also considered a commodity currency due to the country’s abundance in natural resources and large export of aluminium, iron, and gold.

Conclusion

With a wide selection of major, minor, and exotic currency pairs, traders have the luxury of choice. For beginners, you can consider studying major currency pairs as price movements are more stable compared to minor or exotic currency pairs. With a Vantage trading account, traders can easily access over 40 currency pairs in the global Forex markets through MetaTrader 4 and Metatrader 5 trading platforms. Curious about the currency pairs Vantage offers? Sign up a demo account here and start trading.

References

- What Are the Most Commonly Traded Currency Pairs? (2021, August 5). Investopedia. https://www.investopedia.com/ask/answers/06/maincurrencypairs.asp. Accessed 1 Jan 2024.

- Alkhanjary, L. (2022, August 2). Major, Minor and Exotic Currency Pairs – Kinesis Money. Kinesis. https://kinesis.money/blog/major-minor-and-exotic-currency-pairs-guide/. Accessed 1 Jan 2024.