Hot US CPI hits stocks and gold, boosts dollar

Headlines

* Investors scale back bets on May rate cut post-strong US CPI

* USD rises to multi-month highs, stocks suffer worst day in a year

* JPY weakens through 150 per dollar, raising intervention risk

* Gold slides below $2,000 for first time in two months

FX: USD’s recent bullish consolidation saw another upside breakout after stronger than expected CPI data. The inflation report was disappointing with shelter costs impacting heavily. The DXY hit three-month highs and is nearing 105. Treasury yields moved sharply higher from 4.15% to 4.32% in the 10-year. Bets on a May rate cut shifted from above 60% to 35% after the release with less than 100bps now priced in for 2024. It was only a few weeks ago that markets priced in seven 25bp cuts with the first one in March.

EUR collapsed after the US data as the major hit three-month lows. It dipped below 1.07 but is trying to hold above there currently. The German ZEW business survey increased in February with areas of optimism. Next support is 1.07 and 1.0656.

GBP was the best performing major against the dollar. It is similar for the month and also year-to-date. A big reason is still sticky wage growth figures. Both earnings figures beat estimates by two-tenths with the ex-bonus number still above 6%. The jobless rate dipped two-tenths to 3.8%, though the data is seen as unreliable.

USD/JPY hit three-month highs surging past 150. The previous cycle top is at 151.94 but through 150 could trigger jawboning from Japanese officials to support the currency.

AUD plunged to levels last seen in November. Support below 0.65 was broken. USD/CAD popped up to 1.3586 and highs last touched in December. The midpoint of the November sell-off is at 1.3538.

Stocks: US equities tumbled on the strong CPI data and policy easing bets being further reined in. The benchmark S&P 500 lost 1.37% to settle at 4,953. The tech-heavy Nasdaq 100 shed 1.58% to close at 17,600. The Dow Jones closed down 1.36% to settle at 38,275. It was the Dow’s biggest one-day percentage loss since March 2023. Hotel groups were among the worst performers as sector leader and the world’s biggest hotel chain Marriott warned of slowing revenue growth as travel demand slows.

Asian futures are in the red. APAC stocks traded mixed as several markets reopened after an extended weekend. The ASX 200 was choppy while the Nikkei 225 outperformed on strong tech earnings and hit a 34-year high. The semiconductor group Tokyo Electron jumped over 13% after it raised its revenue and profit guidance.

Gold slid as the dollar and yields surged. Prices dropped below $2000 to levels last seen in mid-December. The 100-day SMA is at $1989 with the 50% retracement level of the Q4 rally just below at $1979.

Day Ahead – UK CPI sticky and elevated

Expectations are for headline CPI to rise to 4.2% y/y from 4.0%, with the core rate expected to cool one-tenth to 5.0%. The key services inflation print is forecast to tick higher to 6.9% y/y from 6.4%.

Base effects will likely disrupt the recent run of downside surprises relative to MPC expectations. Inline prints should cement scepticism over imminent rate cuts by the MPC and push back market pricing. A first 25bps reduction is now seen in September, with less than 65bps of easing seen by year-end.

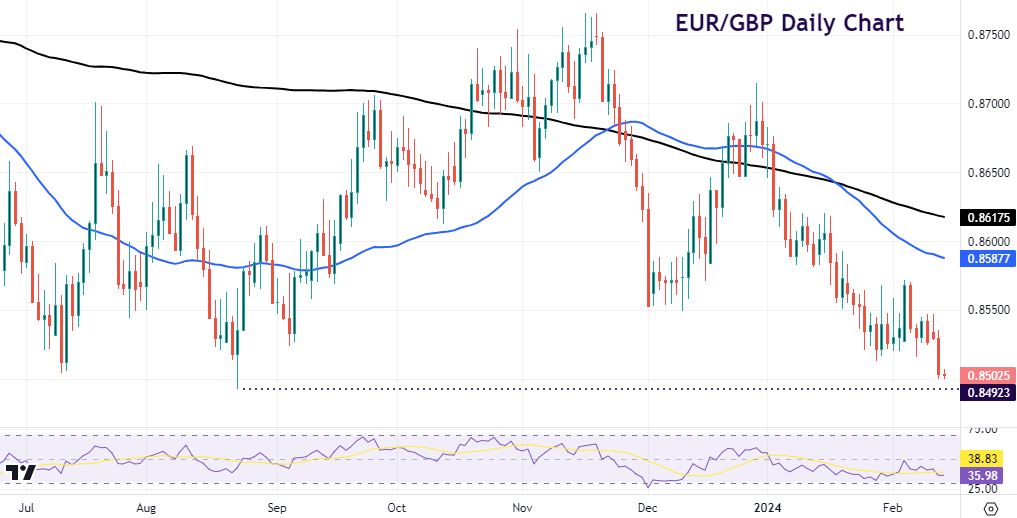

Chart of the Day – EUR/GBP drops to multi-month lows

UK labour market data published yesterday was stronger than expected. The unemployment rate dropped, and average weekly earnings remain above 6%. The data suggests that there is little reason for the BoE to rush to cut rates. There are more mixed views at the ECB regarding the start of rate cuts, but the eurozone economy is in a far worse state.

EUR/GBP broke down yesterday, close to levels last seen in August 2023, at 0.8492. Just above here is the July bottom at 0.8504. This zone should again offer strong support. Lose this and the next initial level is 0.8471 and then below 0.84.