Powell largely sticks to the script, markets relatively quiet

Headlines

* Powell cautions on labour market in testimony, USD edges higher

* Yet more fresh record highs for S&P 500 and Nasdaq 100

* Gold holds steady as traders await US inflation data for more Fed clues

* Bitcoin’s correlation with tech breaks down amid supply “overhang”

FX: USD was bid for a second straight day in a relatively small range. Powell kept his options open on rate cut timing. But he said holding rates high for too long could jeopardise economic growth. As well as inflation risks, the recent job market data sent a clear signal that it has “cooled considerably”. The 50-day SMA sits at 105.08.

EUR printed an inside day settling modestly lower on the day. The 200-day SMA currently sits at 1.08. There were a few ECB officials with mixed comments about reducing rates gradually, though another said the ECB does not lower rates on autopilot.

GBP saw marginal weakness trading around 1.28 and closing just below. Chief Economist Pill speaks today with expectations that he may come out more dovishly. That will battle with the stable (political) state of the UK and underlying bid, which contrasts with Europe, France and the US.

USD/JPY moved higher above the 161 mark. The recent multi-decade high sits at 161.95 from the start of the month. Discussions about BoJ bond buying didn’t upset markets.

AUD consolidated just below at 0.6761, a level last seen at the start of the 2024. The NAB business confidence index rose to its highest level since January 2023. USD/ CAD printed a very small inside day doji candle. There’s around a 64% chance of another BoC rate cut at the 24 July meeting.

US Stocks: US markets again made more fresh record highs and closes, though the ranges were yet again very small with volatility squashed. Financials and healthcare were the main winners while materials and energy were the laggards. The benchmark S&P 500 settled 0.07% higher at 5,577. The tech heavy Nasdaq 100 finished 0.07% up at 20,453. The Dow Jones closed 0.13% lower at 39,292. Powell was generally supportive of risk taking, though of course the Fed needs greater confidence to kick off policy easing. Tesla cruised to a 10-day win streak, closing at its highest point in nine months. That’s its longest stretch of consecutive increases since it rose 13 straight trading days last June. Over the past 10 sessions, the stock is up 43.7% and 5.6% on the year. But that 2024 performance is still the worst of the Mag 7.

Asian stock futures are mixed. Asian stocks were also mixed not really building on the fresh all-time highs on Wall Street. The ASX 200 moved up on real estate and tech. The Nikkei 225 made more record highs on tech. The Hang Seng was muted falling to levels last seen over two months ago. The Shanghai Composite was subdued too on ongoing trade frictions.

Gold printed a small range day after the yo-yoing seen in the last two days. Lower inflation expectations from the New York Fed hit bugs at the start of the week. We note gold ETF buying turned positive in May after this year in decline with Asia and Europe leading global inflows.

Day Ahead – RBNZ Meeting

New Zealand’s central bank will keep its cash rate unchanged at 5.50% today. Markets are priced for no change at this meeting, with more material cut pricing kicking in from October. That is somewhat different to the RBNZ’s current guidance who do not expect a cut until well into 2025 and at a very modest initial pace. The RBNZ’s explicit guidance was provided in the May version of the Monetary Policy Statement, but the next update isn’t expected until the mid-August meeting.

That August meeting will be informed by the July release of Q2 inflation data. The non-tradeable component is key as that is more likely to be determined by domestic activity. This measure has not been cooling down to an acceptable rate in keeping with the RBNZ’s overall 2% inflation target. It all means for this meeting, a likely continued hawkish bias with the bank reiterating two-sided risks. Consistently higher Australia CPI prints will also have grabbed the RBNZ’s attention.

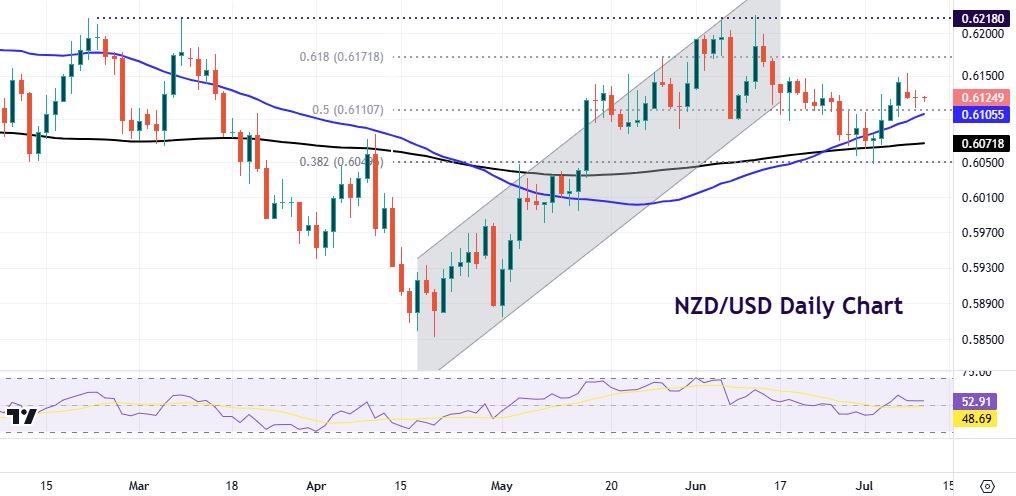

Chart of the day – Can a more hawkish RBNZ help NZD?

The tone of the RBNZ will be key for the kiwi and price action. A hawkish hold was seen at the May meeting, but Governor Orr hasn’t been as hawkish with some of his recent commentary. Aside from the RBNZ, the US macro picture and Fed rate expectations will also direct the major, with NZD a pro-cyclical currency. China sentiment could also be important in the build-up to the US presidential election.

Prices recently found support at the 200-day SMA in late June and earlier this month around 0.605/71. A major Fib retracement level (38.2%) of the December high and April low also sits just below here. Strong resistance resides at the February, March and June tops at 0.6216/21.