Weekly Outlook | Dollar weakness, positive risk appetite

Important events this week:

There are only a few important news events during this trading week. In the US, Joe Biden has continued to reiterate that he is the best candidate to run for the Democrats. He also presented a better picture during a TV interview than in the previous TV debate.

In France, the election is unlikely to produce any major surprises, but could further strengthen the EUR. As there were no signs of an absolute right-wing majority last week, the single currency was able to rise again. This trend remains intact.

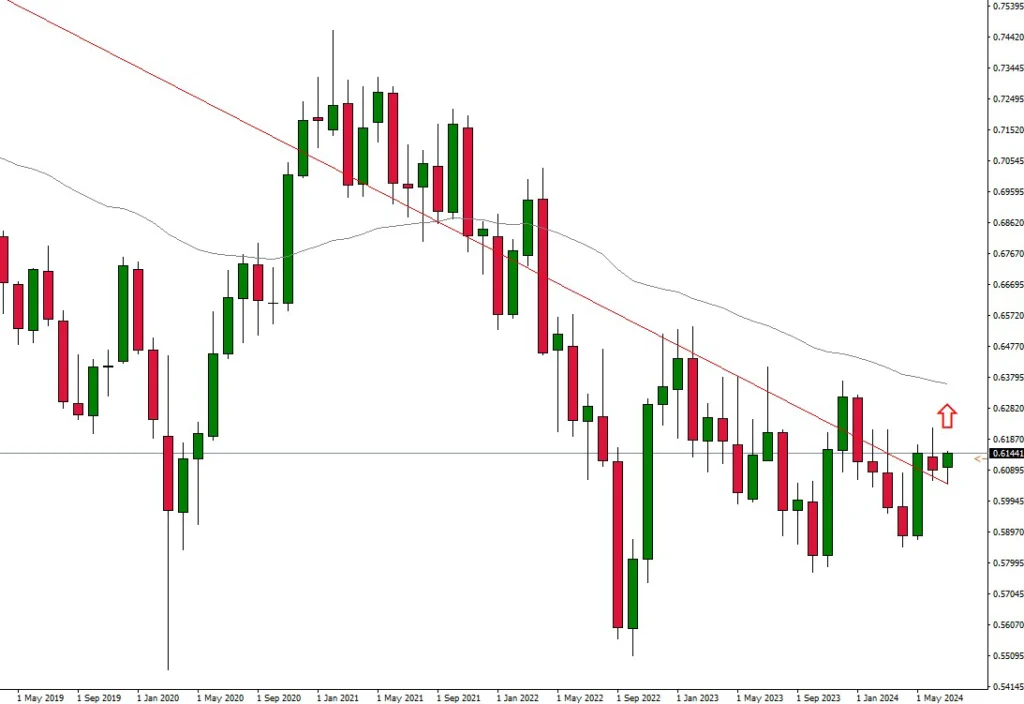

– NZ – Interest rate decision – The interest rate decision in New Zealand will be the most important event this week. It is expected that rates will remain unchanged at 5.50 %. The New Zealand Dollar could then rise further, especially against Greenback. This trend can be seen also in the long-term charts.

The monthly chart indicates further upward potential. The falling trend line in red color has been broken upwards. Above the USD 0.6200 mark, the positive trend might intensify and prices could move towards USD 0.6360, where the 50- moving average resistance will then come into focus. The interest rate decision by the RBNZ will take place on Wednesday, 10 July at 04:00 CET.

– US inflation rate – The consumer price index from the US could provide further insight into the course of interest rates and therefore the behavior of the Fed. It is hardly expected that rates will be reduced. There might only be one adjustment before the end of the year, as consumer prices are currently moving downwards slowly. A consumer price index of 3.1% is expected for the annual rate, down from 3.3% previously. If this figure materializes, it could put the Dollar under renewed pressure.

A look at the USD index (USDX) shows further downside potential. The price has fallen below the rising trend line, which generally indicates a weak Dollar. The Greenback could therefore show further losses against other currencies. The GBP is looking very strong at the moment and could continue to soar. The new government also supports further clarity there. The data will be published on Thursday, 11 July at 14:30 CET.

– US consumer confidence – last week’s better-than-expected NFP figure on Friday only strengthened the Dollar in the short term. The negative trend seems to be continuing. Although consumer confidence is not an important indicator, it could weaken the Greenback further if it comes out weaker.

Further pressure could develop against the JPY. The Yen did not weaken further against the Dollar last week, but is showing possible positive momentum. The correction could intensify below the USD 160.00 mark. The data will be published on Friday, 12 July at 16:00 CET.